Bringing Employee Benefits Full Circle

What We Do

We help you maximize financial health and employee satisfaction by strategizing, designing, and implementing employee benefit plans that are customized around your objectives and goals.

Who We Are

We are a team of analysts, consultants, and strategists, who are passionate about our clients and who strive daily for responsiveness and efficiency.

Customized Benefit Plans

We offer all lines of benefits, and will design a strategy that works for your organization, culture, and philosophy.

Experienced

Our consultants have 50+ combined years of experience in the industry.

Reliable

Personalized, no-nonsense, effective, and efficient service. We are a dependable team that becomes part of your team.

Client and Employee Support

From online resources, to presentations in English and Spanish, we’re just a phone call or email away. Let us know what you need.

Speak with one of our Benefit Consultants today.

Articles and Events

National Cheese Day! 🧀

Celebrate National Cheese Day with your favorite cheesy delight! #CheeseLovers #Yum

Daily Mental Health Checklist📝

Your mental health includes how you think, feel and act, as well as your emotional and social well-being. Mental health can change over time, depending on factors like workload, stress and work-life balance. Taking care of your mental health doesn’t have to be overwhelming. Small, consistent actions can make a big difference in how you …

Remember and Honor💙❤️

On Memorial Day, we honor the brave who sacrificed for our country, laying the foundation of our freedoms. We thank and support their families, upholding the values they fought for. #MemorialDay #RememberingTheFallen

U.S. Prescription Drug Spending Rose 10.2% in 2024📈

A new report from the American Society of Health System Pharmacists (ASHP) revealed that prescription drug spending in the United States reached nearly $806 billion in 2024, up 10.2% from 2023. The increase was largely driven by the demand for weight loss medications, including glucagon like peptide-1 (GLP-1) drugs. GLP-1 medications are prescribed for diabetes …

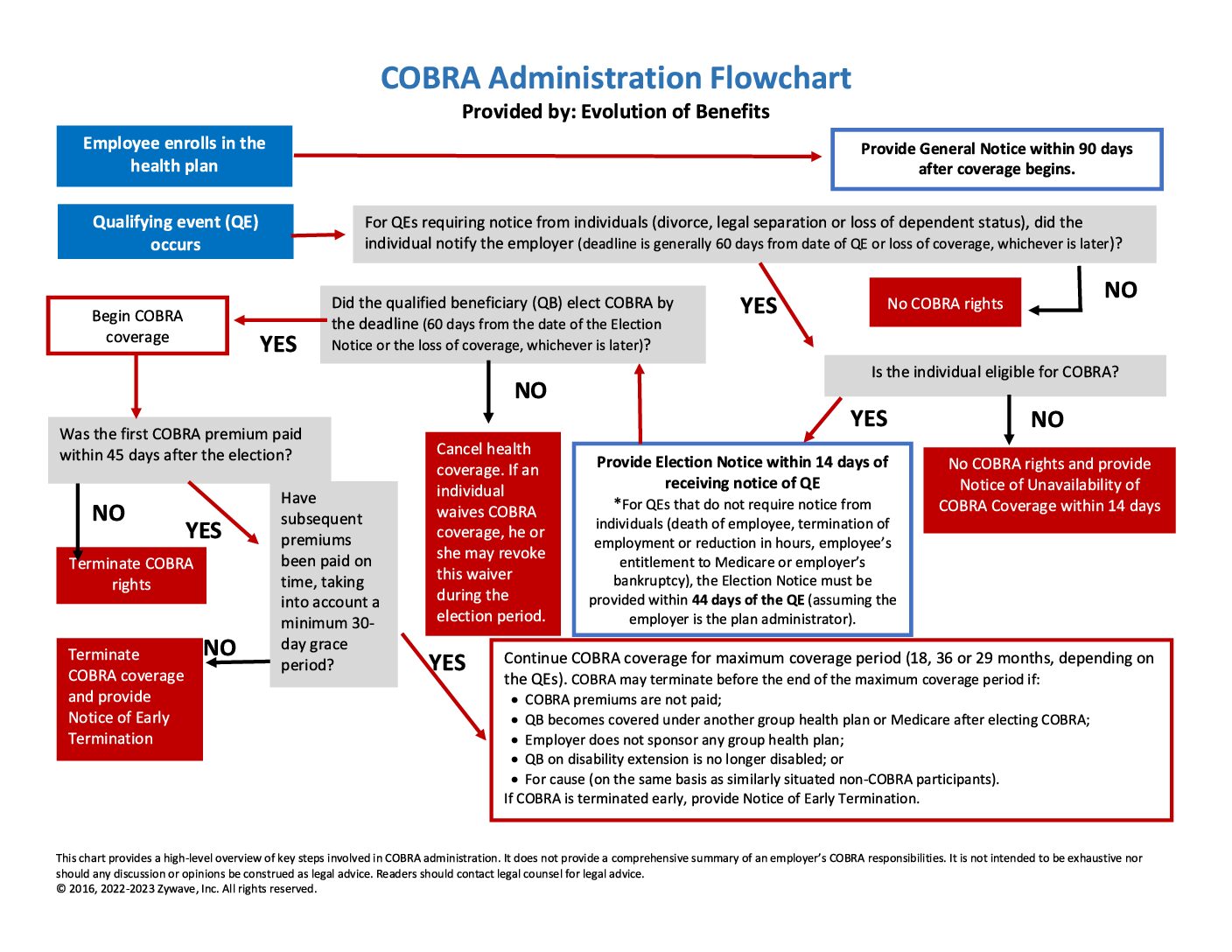

COBRA Administration Flowchart

Please click on the link below for more to view.

Health Plans Must Expand Coverage for Breast Cancer Screening for 2026🎀

Effective for plan years beginning after Dec. 30, 2025, group health plans and health insurance issuers must expand their first-dollar coverage for preventive care for women to include additional breast cancer imaging or testing that may be required to complete the initial mammography screening process. In addition, health plans and issuers must cover patient navigation …

Helping Employees Manage Out-of-Pocket Medical Expenses💰💲

The rising cost of health care, including prescription drugs, has made it increasingly difficult for employees to afford medical care. Employees may forgo medical care to avoid out-of-pocket costs, even when such care is recommended or necessary. Employees who do receive medical care may struggle to pay their health care bills. High-deductible health plans (HDHPs) …

New Executive Order Aims to Reduce Drug Costs by Aligning with Global Prices📉

On May 12, 2025, President Donald Trump issued an executive order (EO) that aims to bring the prices Americans pay for prescription drugs in line with those paid by similar nations. According to a White House fact sheet, the prices Americans pay for brand-name drugs are more than three times the price other nations pay. …

Biosimilar Market Trends

A decade after the first biosimilar approval, these medications are still gaining approval from the U.S. Food and Drug Administration (FDA) and entering the market each year. Biosimilars are the most cost-efficient type of biologic medication, and they are safe and effective for treating many illnesses. Not only do these drugs have the potential to …

7 Spring Well-being Tips🌿🧺🌼

Spring is often associated with warmer weather, increased sunlight and more opportunities to spend time outdoors. These changes can impact your physical and mental well-being, providing you an opportunity to take positive steps to improve your health. This article explores the significance of spring well-being and offers several practical suggestions for making the most of …